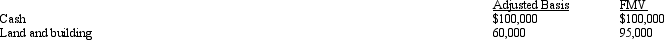

Marsha is going to contribute the following assets to a business entity in exchange for an ownership interest.

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

Definitions:

Transformational Leadership

A leadership style that inspires positive changes in those who follow, often by creating a vision of the future, motivating and enhancing the morale and performance of followers.

360-Degree Feedback

A feedback process where employees receive confidential, anonymous feedback from those who work around them, including peers, managers, and direct reports.

User-Friendly Factory Machinery

Industrial equipment designed with an emphasis on ease of use, efficiency, and safety for the operator.

Human Factors Psychologists

Professionals who study how people interact with machines and environments to improve safety, efficiency, and productivity.

Q2: Pail Corporation is a merchandiser. It purchases

Q3: Which citation refers to a U.S. Tax

Q12: A partner has a profit-sharing percent, a

Q29: "Temporary differences" are book-tax income differences that

Q31: Neither the 1939 nor the 1954 Code

Q46: A cash basis calendar year C corporation

Q47: S corporations must withhold taxes on the

Q58: Are organizations that qualify for exempt organization

Q68: Amelia, Inc., is a domestic corporation with

Q71: Well, Inc., a private foundation, makes a