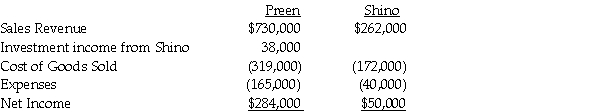

Preen Corporation acquired a 60% interest in Shino Corporation at a cost equal to 60% of the book value of Shino's net assets in 2014. At the time of acquisition, the book value and fair value of Shino's assets and liabilities were equal. During 2015, Preen sold $120,000 of merchandise to Shino. All intercompany sales are made at 150% of Preen's cost. Shino's beginning and ending inventories resulting from intercompany sales for 2015 were $60,000 and $36,000, respectively. Income statement information for both companies for 2015 is as follows:

Required:

Required:

Prepare a consolidated income statement for Preen Corporation and Subsidiary for 2015.

Definitions:

Singlehood

The state of being unmarried or not involved in a romantic partnership, which may be a personal choice or circumstance.

Adult

A person who has reached a stage of maturity in which they have attained full physical development and are considered legally responsible for their actions.

Disadvantages

Aspects of a situation that make it more difficult to achieve success or that put one at a lesser position compared to others.

Gender Roles

Gender roles are societal norms dictating the types of behaviors that are considered acceptable, appropriate, or desirable for people based on their actual or perceived sex.

Q7: Sabu is a 65%-owned subsidiary of Peerless.

Q9: Molly is a 40% partner in the

Q15: In the business combination of Polka and

Q25: What basis of accounting is used to

Q30: Stilt Corporation purchased a 40% interest in

Q30: Stephanie is a calendar year cash basis

Q30: Which trial court hears only tax disputes?<br>A)

Q32: If the average capital balances for Bertram

Q33: In a proportionate liquidating distribution, Alexandria receives

Q46: When property is contributed to a partnership