Note to Instructor: This exam item is similar to Exercise 3 except that the exchange rates have been changed and the temporal method is used instead of the current rate method.

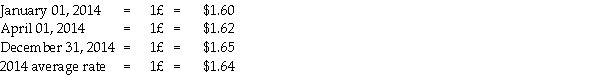

The Polka Corporation, a U.S. corporation, formed a British subsidiary on January 1, 2014 by investing 550,000 British pounds (£) in exchange for all of the subsidiary's no-par common stock. The British subsidiary, Stripe Corporation, purchased real property on April 1, 2014 at a cost of £500,000, with £100,000 allocated to land and £400,000 allocated to the building. The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value. The U.S. dollar is Stripe's functional currency, but it keeps its records in pounds. The British economy does not experience high rates of inflation. Exchange rates for the pound on various dates are:

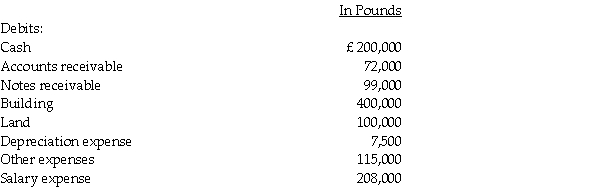

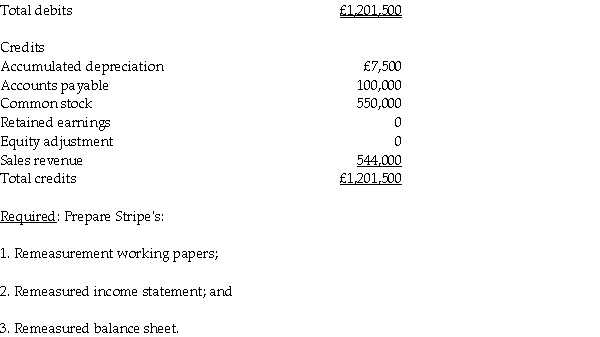

Stripe's adjusted trial balance is presented below for the year ended December 31, 2014.

Stripe's adjusted trial balance is presented below for the year ended December 31, 2014.

Definitions:

Rods

Photoreceptor cells in the retina of the eye that are sensitive to low light levels and are primarily responsible for night vision.

Dim Light

A low level of illumination, often creating a subdued or intimate atmosphere.

Retina

A light-sensitive layer at the back of the eye responsible for capturing images and converting them into electrical signals for the brain to interpret.

Visual Receptors

Specialized cells located in the retina that convert light into neural signals enabling vision.

Q2: Enterprise funds are accounted for in a

Q7: The City's municipal golf course had the

Q8: The duties of a debtor in possession

Q12: At the end of 2013, the partnership

Q17: The following information was taken from the

Q28: From the standpoint of accounting theory, which

Q30: Middlefield County incurred the following transactions during

Q33: Goodwill was reported in the December 31,

Q39: If the sale of merchandise is denominated

Q85: Match the statements that relate to each