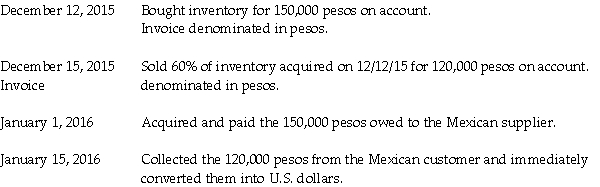

Johnson Corporation (a U.S. company) began operations on December 1, 2015, when the owner contributed $100,000 of his own money to establish the business. Johnson then had the following import and export transactions with unaffiliated Mexican companies:

The following exchange rates apply:

The following exchange rates apply:

Required:

Required:

1. What were Sales in the income statement for the year ended December 31, 2015?

2. What was the COGS associated with these sales?

3. What is the Accounts Payable balance in the balance sheet at December 31, 2015?

4. What is the Inventory balance in the balance sheet at December 31, 2015?

Definitions:

Annual Net Income

Annual Net Income refers to the amount of money earned in one fiscal year after all expenses and taxes have been subtracted.

Partnership

A legal form of business operation between two or more individuals who share management and profits or losses.

Urban Roads

Roads located within cities and towns, often characterized by higher traffic volumes and varying degrees of complexity in their network.

Open Road

Often used metaphorically to represent freedom and the journey of life; in a literal sense, it refers to a clear, unobstructed roadway.

Q5: Which, if any, of the following factors

Q10: Parrot Incorporated purchased the assets and liabilities

Q18: Que, Rae, and Sye are in the

Q31: Anthony and Cleopatra create a joint venture

Q35: Stello Corporation's stockholders' equity on December 31,

Q37: On January 15, 2012, Vern purchased the

Q40: A taxpayer may carry any NOL incurred

Q68: One indicia of independent contractor (rather than

Q125: A football team that pays a star

Q152: Aaron is a self-employed practical nurse who