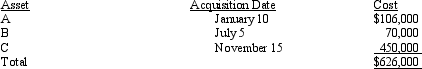

Audra acquires the following new five-year class property in 2012:

Audra elects § 179 for Asset

Audra elects § 179 for Asset

C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra takes additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Occipital Lobe

The region of the brain located at the back of the head, responsible for processing visual information.

Visual Perception

The ability to interpret the surrounding environment using light in the visible spectrum reflected by the objects in the environment.

Cerebral Cortex

The outer layer of neural tissue of the cerebrum in the brain, playing a key role in memory, attention, perception, cognition, awareness, thought, language, and consciousness.

Self-Identity

An individual's conscious recognition of their own character, feelings, motives, and desires.

Q12: In computing consolidated diluted EPS, the replacement

Q16: On January 1, 2014, Jeff Company acquired

Q20: Sandpiper Corporation paid $120,000 for annual property

Q27: Father made an interest-free loan of $25,000

Q34: Jacana Company uses the LIFO inventory method.

Q36: Trade and business expenses should be treated

Q40: Brooke works part-time as a waitress in

Q78: How are combined business/pleasure trips treated for

Q87: Green, Inc., manufactures and sells widgets. During

Q122: Briefly explain the provisions regarding the deductibility