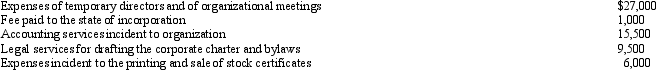

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2012. The following expenses were incurred during the first tax year (April 1 through December 31, 2012) of operations:  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2012?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2012?

Definitions:

Inventory Holding Period

Inventory holding period measures the average time a company holds inventory before selling it, reflecting the efficiency of inventory management and its impact on cash flow.

Payables Deferral Period

The average length of time between a firm’s purchase of materials and labor and the payment of cash for them. It is calculated by dividing accounts payable by credit purchases per day (cost of goods sold/365).

Line of Credit

A flexible loan arrangement with a financial institution that allows a borrower to draw upon funds up to a specified limit at their discretion.

Financial Strength

The ability of an entity to meet its financial obligations, often evaluated through metrics like liquidity ratios, solvency ratios, and profitability.

Q4: Kathleen transferred the following assets to Mockingbird

Q25: Which items tell taxpayers the IRS's reaction

Q26: In 1916, the Supreme Court decided that

Q44: Yoko purchased 10% of Toyger Corporation's stock

Q52: In 2012, Norma sold Zinc, Inc., common

Q77: Section 1231 property includes nonpersonal use property

Q94: In May 2011, Egret, Inc.issues options to

Q114: Tammy expensed mining exploration and development costs

Q116: The C corporation AMT rate can be

Q137: Nondeductible meal and entertainment expenses must be