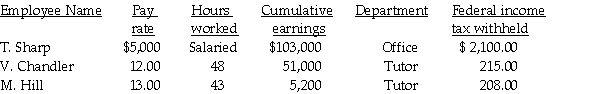

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total gross earnings for the tutors.

Definitions:

Validity

The extent to which a concept, conclusion, or measurement is well-founded and likely corresponds accurately to the real world.

Egocentric Fallacy

The mistaken belief that one's own personal experience or values are universal.

Ethnocentrism

The belief in the superiority of one's own ethnic group or culture over others.

Phallocentrism

A cultural perspective that prioritizes the male perspective and the phallus as a symbol of male dominance.

Q4: Great Lakes Tutoring had the following payroll

Q6: The contra-revenue accounts include:<br>A)Sales Tax Payable.<br>B)Sales Returns

Q12: Hal is enrolled for one class at

Q18: There is no general partner required in

Q50: Sales Tax Payable represents an asset on

Q71: What liability account is reduced when the

Q73: The debit amount to Payroll Tax Expense

Q86: A form used to organize and check

Q101: The depreciation of equipment will require an

Q106: Checks that have been processed by the