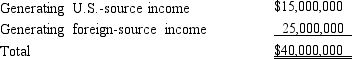

Goolsbee, Inc., a U.S. corporation, generates U.S.source and foreignsource gross income. Goolsbee's assets (tax book value) are as follows.

Goolsbee incurs interest expense of $200,000. Using the asset method and the tax book value, apportion interest expense to foreign-source income.

Goolsbee incurs interest expense of $200,000. Using the asset method and the tax book value, apportion interest expense to foreign-source income.

Definitions:

Neanderthal Genes

Genetic sequences inherited from Neanderthals, present in the DNA of modern humans outside Africa.

Genetic Markers

Genetic markers are sequences of DNA that can be used to identify individuals or species, and are often employed in genetic mapping, forensic analysis, and study of genetic predispositions to diseases.

Australopiths

Refers to a group of extinct hominins closely related to humans, known for their bipedal locomotion and significant role in human evolution.

Hominins

Members of the human lineage after the split from our common ancestor with chimpanzees, including all modern and extinct human species.

Q7: ParentCo and SubOne have filed consolidated returns

Q29: The December 31, 2014, balance sheet of

Q49: The stock in Crimson Corporation is owned

Q75: A controlled foreign corporation (CFC) realizes Subpart

Q100: Kilps, a U.S. corporation, receives a $200,000

Q109: ForCo, a subsidiary of a U.S. corporation

Q120: Catherine's basis was $50,000 in the CAR

Q129: Schedules M-1 or M-3

Q154: Income of foreign person taxed through filing

Q156: Which of the following potentially is a