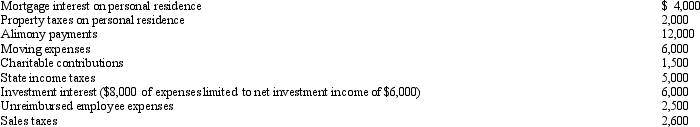

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Definitions:

Preferred Dividends

Regular payments made to preferred shareholders out of the company's profits before any dividends are paid to common shareholders.

Weighted Average

A calculation that takes into account the varying degrees of importance of the numbers in a data set, assigning more weight to some numbers and less to others.

Earnings Per Share

A financial metric that measures the amount of a company's profit allocated to each outstanding share of its common stock.

Outstanding Common Stock

Shares of a corporation's stock that have been issued and are in the hands of investors, but not repurchased by the company.

Q4: On February 20, 2011, Bill purchased stock

Q18: Red Corporation incurred a $15,000 bad debt

Q21: A taxpayer may elect to use the

Q26: If part of a shareholder/employee's salary is

Q30: A business bad debt is a debt

Q67: Which of the following costs would not

Q68: In 2011, Robin Corporation incurred the following

Q89: In 2012, Morley, a single taxpayer, had

Q114: A participant has an adjusted basis of

Q139: Ramon and Ingrid work in the field