Answer the following question(s) using the information below:

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result.The following information was collected for the month of October:

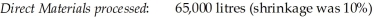

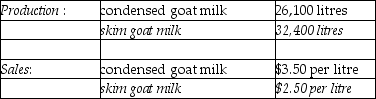

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

-What is the estimated net realizable value of the skim goat ice cream at the splitoff point?

Definitions:

Transference

In psychoanalysis, the process by which emotions and desires originally associated with one person are unconsciously shifted to another person.

Mate Selection

The process by which individuals choose their partners based on various factors including, but not limited to, physical attractiveness, personality traits, and socio-economic status.

Mere Exposure Effect

A psychological phenomenon where people tend to develop a preference for things merely because they are familiar with them.

Initially Disliked

Refers to a negative first impression or initial negative feelings towards a person, object, or idea.

Q38: Better Printing sells hardcover and softcover books.For

Q53: Relevant costs for pricing decisions include manufacturing

Q60: Using the stand-alone method with stand-alone product

Q69: Additional insight can be gained by separating

Q117: What is the Rest-a-Lot company cost of

Q121: Define engineered and discretionary costs and give

Q124: In general,profit potential increases with greater competition,stronger

Q133: Which of the following is NOT a

Q148: What is the Luke Company's cost effect

Q150: What is the Zorro Company market-size variance?<br>A)$500