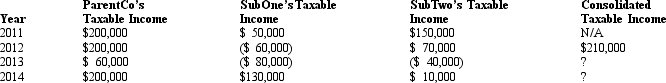

ParentCo,SubOne and SubTwo have filed consolidated returns since 2012.All of the entities were incorporated in 2011.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  How should the 2013 consolidated net operating loss be apportioned among the group members?

How should the 2013 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

Definitions:

Ending Work

Often referred to the ending work in process (WIP) inventory, it represents the value of products that are partially completed at the end of an accounting period.

Process Inventory

Inventory that is currently in various stages of the production process but not yet completed.

Manufacturer

An individual or company involved in the process of making goods for sale through the use of raw materials, components, or assemblies.

Schedule

A detailed plan that lists activities, tasks, or events with their intended timeframes.

Q16: A transfer pricing system should satisfy which

Q24: _ is the process of identifying, describing,

Q31: Brad Company developed the following budgeted life-cycle

Q44: Using the abbreviations listed below, indicate for

Q48: Roberts, SA., manufactures a product that experiences

Q52: Rob and Fran form Bluebird Corporation with

Q55: Refer to Figure 6 above. The Jones

Q78: Given the following information,determine whether Greta,an alien,is

Q110: The sale of § 306 stock to

Q140: Compute consolidated taxable income for the calendar