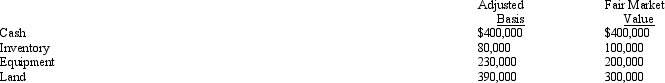

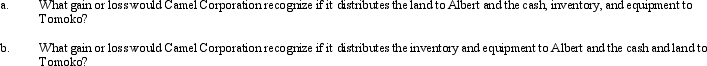

The stock in Camel Corporation is owned by Albert and Tomoko,who are unrelated.Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation.All of Camel Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Camel Corporation:

Definitions:

Express Contract

A contract explicitly stated by the parties, either orally or in writing, detailing the terms clearly.

Contract Formed

refers to the creation of a legally binding agreement that arises when an offer by one party is accepted by another party, meeting the necessary legal requirements.

Unilateral Contract

A contract where one party makes a promise in exchange for the performance of a specified act by the other party, who is not obligated to perform.

Quasi Contract

An obligation imposed by law to prevent unjust enrichment, where no actual contract exists.

Q13: ParentCo and SubCo had the following items

Q26: One of the tenets of the U.S.tax

Q29: Most of the rules governing the use

Q51: Tina incorporates her sole proprietorship with assets

Q63: Campbell,Inc. ,a calendar year corporation that was

Q77: When the § 382 limitation is evoked,the

Q86: The U.S.system for taxing income earned outside

Q87: Under the "check-the-box" Regulations,a two-owner LLC that

Q98: Harry,the sole income beneficiary,received a $40,000 distribution

Q133: "First-tier distributions" allowed by the will or