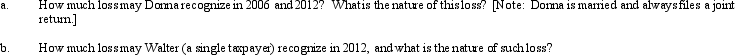

In 2005,Donna transferred assets (basis of $300,000 and fair market value of $250,000)to Egret Corporation in return for 200 shares of § 1244 stock.Due to § 351,the transfer was nontaxable;therefore,Donna's basis in the Egret stock is $300,000.In 2006,Donna sells 100 of these shares to Walter (a family friend)for $100,000.In 2012,Egret Corporation files for bankruptcy,and its stock becomes worthless.

Definitions:

Incoming Partner

An individual who is joining a partnership, often contributing capital or other resources to the business.

Terminated

The act of bringing something to an end or the state of being brought to an end; in employment, it refers to the discontinuation of a person's employment.

Turned into Cash

The process of converting assets or investments into liquid funds or cash.

Obligations

Represents legal or financial responsibilities or duties that an entity is required to fulfill, such as paying debts or performing services under a contract.

Q6: Winston is classified as a grantor trust,because

Q11: Amber Company has $400,000 in net income

Q18: To qualify as a tax-free reorganization,a corporate

Q40: Under certain circumstances,a distribution can generate (or

Q74: Duck Corporation is a calendar year taxpayer

Q81: Even if boot is generated under §

Q93: A city contributes $500,000 to a corporation

Q99: Grackle Corporation (E & P of $600,000)distributes

Q103: Warbler Corporation,an accrual method regular corporation,was formed

Q131: Olsen has been determined to be a