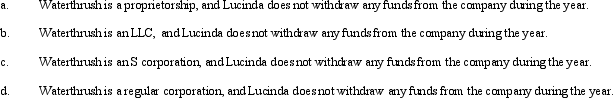

During the current year,Waterthrush Company had operating income of $510,000 and operating expenses of $400,000.In addition,Waterthrush had a long-term capital gain of $30,000.How does Lucinda,the sole owner of Waterthrush Company,report this information on her individual income tax return under following assumptions?

Definitions:

Histogram

A graphical representation that organizes a group of data points into user-specified ranges, showing the frequency of data in each range.

Skewed

Describes a distribution that is not symmetrical, with a majority of values leaning towards one side.

Website Use

The act of accessing and interacting with content on web pages through a web browser, often for information, entertainment, or transactions.

Stem-and-Leaf Display

A method of displaying quantitative data to show its distribution by dividing each value into a "stem" (the leading digits) and a "leaf" (the last digit).

Q10: Matt and Patricia are husband and wife

Q11: Amber Company has $400,000 in net income

Q41: Zane makes a gift of stock in

Q42: Reasonable needs for purposes of the accumulated

Q72: Dustin owns all of the stock of

Q95: Minnie,your tax client,has decided to dispute the

Q97: Certain individuals are more likely than others

Q99: The Gable Trust reports $20,000 business income

Q100: Jose is subject to the top marginal

Q142: Dexter established a divorce trust to benefit