On October 2,2016,Miriam sells 1,000 shares of stock at $20 per share.Miriam acquired the stock on November 12,2015,when she exercised her option to purchase the shares through her company's incentive stock option plan.The exercise price was $11 per share and the fair market value of the stock at the date of exercise was $14 per share.For 2016,Miriam must report

Definitions:

Present Value

The discounted value of a future cash flow, taking into account a specific rate of interest.

Market Rate

The current price or rate at which a good or service can be bought or sold in a given market.

Compound Interest

Interest on a loan or deposit calculated based on both the initial principal and the accrued interest from previous periods.

Callable Bonds

Bonds that can be redeemed by the issuer before their maturity date at a pre-specified price.

Q1: Brooks Corporation distributes property with a basis

Q3: Which of the following is true about

Q9: The quasi-endowment fund of a university would

Q22: Once a corporation is formed,an exchange of

Q34: A taxable entity has the following capital

Q39: Phillip owns rental real estate with an

Q66: Which of the following qualifies as a

Q71: Raymond,a single taxpayer,has taxable income of $155,000

Q99: Dunn Company bought an old building in

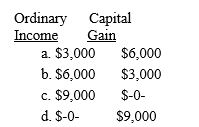

Q127: A taxable entity has the following capital