On January 1, 2016, Pep Company acquired 80% of the common stock of Sky Company for $195,000.On this date Sky had total owners' equity of $200,000 (common stock, other paid-in capital, and retained earnings of $10,000, $90,000, and $100,000 respectively).

?

Any excess of cost over book value is attributable to inventory (worth $6,250 more than cost), to equipment (worth $12,500 more than book value), and to patents.FIFO is used for inventories.The equipment has a remaining life of five years and straight-line depreciation is used.The excess attributable to the patents is to be amortized over 20 years.

?

During 2016 and 2017, Pep has appropriately accounted for its investment in Sky using the simple equity method.

?

On January 1, 2017, Pep held merchandise acquired from Sky for $10,000.During 2017, Sky sold merchandise to Pep for $50,000, $20,000 of which is still held by Pep on December 31, 2017.Sky's usual gross profit on affiliated sales is 50%.

?

On December 31, 2016, Pep sold equipment to Sky at a gain of $10,000.During 2017, the equipment was used by Sky.Depreciation is being computed using the straight-line method, a five-year life, and no salvage value.

?

Required:

?

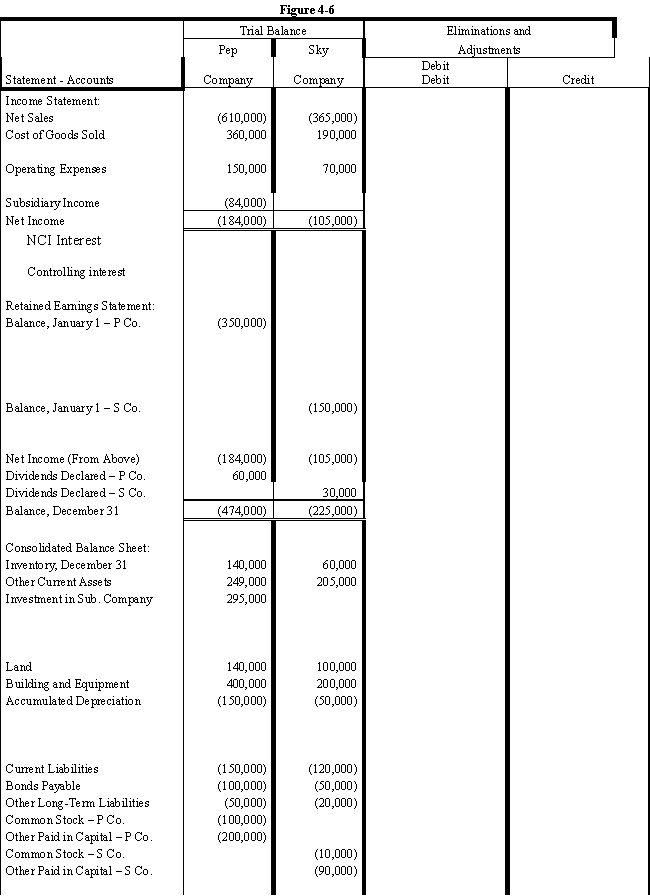

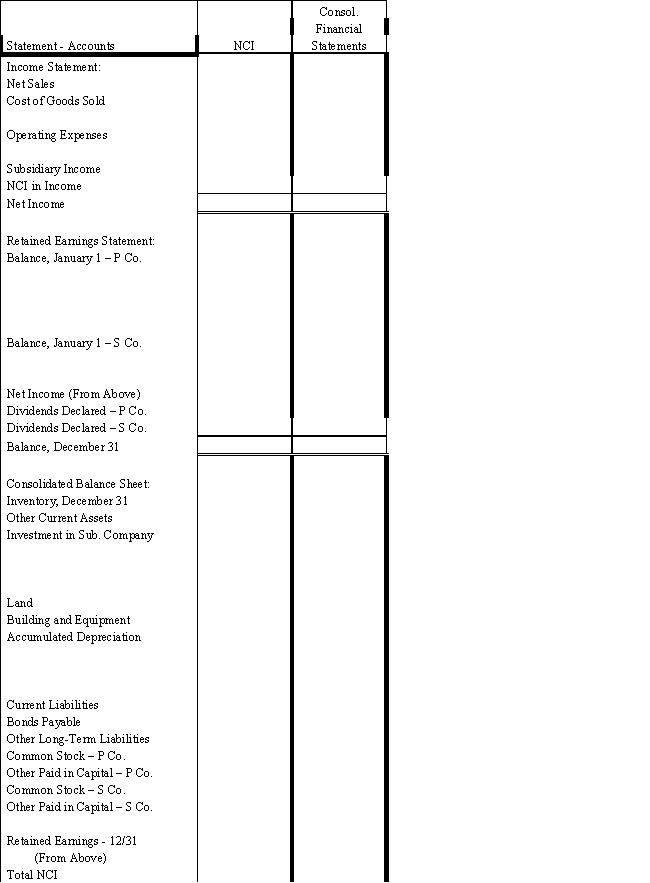

a.Using the information above or on the Figure 4-6 worksheet, prepare a determination and distribution of excess schedule.?

?

b.Complete the Figure 4-6 worksheet for consolidated financial statements for the year ended December 31, 2017.?

?

?

?

Definitions:

Large-scale Simulation

A broad, extensive testing or modeling environment designed to replicate complex systems or environments.

Hypothetical Organization

An imaginary or proposed structure for an organization used for analysis or illustration.

Real-world Industry

Sectors and activities in the economy that produce goods and provide services in natural, tangible, practical, and applied contexts outside of theoretical or simulated environments.

Leader Development

The process of expanding an individual's capacity to perform in leadership roles within organizations.

Q2: A new subsidiary is being formed.The parent

Q3: Assume the articles of partnership state that

Q5: Company P purchased an 75% interest in

Q6: Discuss some of the most visible 21<sup>st</sup>

Q13: Refer to the information below and

Q13: Discuss the criteria emphasized in the "management

Q19: Assume the partnership of V & X

Q24: If differences between the fair value and

Q26: Industrial relations is a broad, interdisciplinary field

Q48: Company S is a 100%-owned subsidiary of