USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

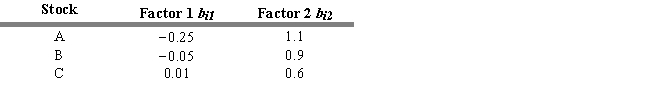

Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return ( 0) = .025 and the risk premiums for the two factors are ( 1) = .12 and ( 0) = .10.

-Refer to Exhibit 7.10. Suppose that you know that the prices of stocks A, B, and C will be $10.95, 22.18, and $30.89, respectively. Based on this information,

Definitions:

Baumrind's Parenting Styles

A classification describing different approaches to parenting, identified as authoritative, authoritarian, permissive, and neglectful, each with distinct characteristics and effects on children's development.

Aggression

Behavior intended to harm or injure another being, whether physically or psychologically.

Psychoanalytic Theorists

Experts in a field founded by Sigmund Freud that focuses on unconscious factors that influence behavior, emotions, and relationships.

Morality

Principles concerning the distinction between right and wrong or good and bad behavior.

Q1: The beta for the DAK Corporation is

Q1: Refer to Exhibit 6A.1. What weight

Q3: Between 1990 and 2000, the standard deviation

Q5: Exchange-Traded Funds (ETF) are depository receipts that

Q27: The most appropriate discount rate to use

Q37: Refer to Exhibit 7.3. The covariance between

Q59: Refer to Exhibit 9.9. What is the

Q69: An investor is risk neutral if she

Q73: The market portfolio consists of all risky

Q188: Refer to Exhibit 9.9. Starting with the