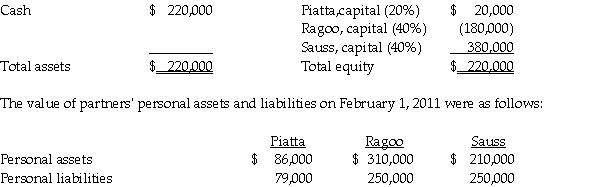

At the end of 2010, the partnership of Piatta, Ragoo, and Sauss was dissolved.By February 1, 2011, all assets had been converted into cash and all partnership liabilities were paid.The partnership balance sheet on February 1, 2011 (with partner residual profit and loss sharing percentages)was as follows:

Required:

Required:

Prepare the final statement of partnership liquidation.

Definitions:

Financing Activity

This refers to the transactions and events that involve raising capital and repaying investors, such as issuing equity or debt.

Cash Dividends

Payments made by a corporation to its shareholder members. It is the share of profits and retained earnings that the company pays out to its shareholders.

Interest Payment

A payment made to a lender by a borrower in exchange for the use of borrowed money, typically calculated as a percentage of the principal.

Accumulated Depreciation

The cumulative depreciation of an asset up to a single point in its life, reflecting the asset's loss in value due to wear and tear, age, or obsolescence.

Q4: If the partnership experiences a net loss

Q6: Consolidated cost of goods sold for Pelga

Q17: Taxes which were billed, but are not

Q24: Packo Company acquired all the voting stock

Q26: On January 1, 2011, Bigg Corporation sold

Q30: If the bonds were originally issued at

Q31: Pheasant Corporation owns 80% of Sal Corporation's

Q37: An increase in income results in an

Q41: Results of the ultimatum game indicate that

Q83: In a centrally planned economy,the government decides