Use the following information to answer the question(s) below.

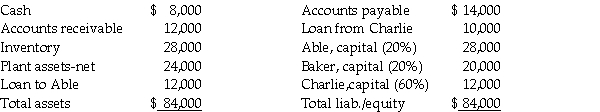

On June 30,2011,the Able,Baker,and Charlie partnership had the following fiscal year-end balance sheet:

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2011,and began the liquidation process.During July the following events occurred:

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2011,and began the liquidation process.During July the following events occurred:

* Receivables of $6,000 were collected.

* All inventory was sold for $8,000.

* All available cash was distributed on July 31,except for

$4,000 that was set aside for contingent expenses.

-The book value of the partnership equity (i.e. ,total equity of the partners) on June 30,2011 is

Definitions:

Certificate of Incorporation

A legal document issued by government authorities granting a company the rights to do business.

Resident District Court Judge

A judge assigned to a specific federal judicial district within the United States, responsible for overseeing cases and legal matters within that region.

Legal Entities

Organizations that have legal rights and obligations, including the ability to enter into contracts and own property, separate from their individual members.

General Public

The collective of individuals in a society, often used to refer to the average consumers or citizens.

Q3: A comprehensive annual financial report has the

Q5: The partnership of May, Novem, and Octo

Q7: Pasten Corporation is liquidating under Chapter 7

Q8: On December 31, 2011, Maria Corporation has

Q11: Avery died testate early in 2011.The following

Q14: Lesher Corporation lost their primary contract and

Q24: Parnaby has 25,000 common stock shares outstanding

Q25: The following information was taken from the

Q38: If the sale of the merchandise was

Q145: During the 2011 Super Bowl,Best Buy ran