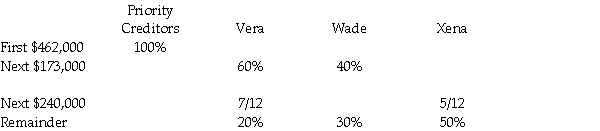

The Vera, Wade, and Xena partnership was dissolved, and a cash distribution plan was developed, as follows:

Required:

Required:

If $1,000,000 of cash was distributed by the partnership, how much was received respectively by the priority creditors, Vera, Wade, and Xena?

Definitions:

Net Income

The total profit of a company after all expenses and taxes have been deducted from revenue, a key indicator of the company's financial health and profitability.

Financial Statements

Documents presenting a summary of a firm's financial status, encompassing the balance sheet, income statement, and cash flow statement.

Book Value

The value of an asset as it appears on a balance sheet, calculated by subtracting any depreciation, amortization, or impairment costs from its original cost.

Fair Value

The estimated market value of an asset or liability based on current market conditions.

Q3: Palmer Company owns a 25% interest in

Q9: Preen Corporation acquired a 60% interest in

Q17: Taxes which were billed, but are not

Q17: Under push-down accounting, the _ of the

Q26: Warren Peace passed away, with his will

Q29: If the intercompany sale was an upstream

Q29: For each of the following events or

Q34: In a Chapter 7 bankruptcy case, what

Q38: On January 1, 2011, Palling Corporation purchased

Q39: What amount of unrealized profit did Pelga