Use the following information to answer the question(s) below.

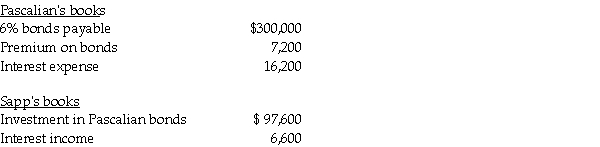

Pascalian Company owns a 90% interest in Sapp Company.On January 1,2010,Pascalian had $300,000,6% bonds outstanding with an unamortized premium of $9,000.The bonds mature on December 31,2014.Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1,2010.Both companies use straight-line amortization of bond discounts/premiums.Interest is paid on December 31.On December 31,2010,the books of the two affiliates held the following balances:

-Consolidated Interest Expense and consolidated Interest Income,respectively,that appeared on the consolidated income statement for the year ended December 31,2010 was

Definitions:

MRC

Marginal Revenue Cost, NO.

Pure Competition

A market structure in which a very large number of firms sells a standardized product, into which entry is very easy, in which the individual seller has no control over the product price, and in which there is no nonprice competition; a market characterized by a very large number of buyers and sellers.

Market Price

The current price at which a good or service can be bought or sold in the open market.

Marginal Revenue Product

The additional revenue generated by employing one more unit of a resource, such as labor or capital.

Q1: Padhy Corporation owns 80% of Abrams Corporation,

Q7: Pacini Corporation owns an 80% interest in

Q11: For internal decision-making purposes, Calam Corporation's operating

Q11: Which fund would most likely report depreciation

Q12: Pinkerton Inc.owns 10% of Sable Company.In the

Q19: Creditor committees are elected<br>A) in all bankruptcy

Q21: On December 31, 2011, Lorna Corporation has

Q25: On January 2, 2011, Power Incorporated paid

Q32: By offering training to workers whose firms

Q277: Discouraged workers are<br>A)workers who have a part