Use the following information to answer the question(s) below.

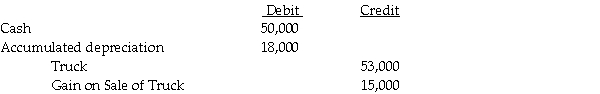

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-The noncontrolling interest share for 2012 was

Definitions:

Lawful Strike

A work stoppage by employees that is legal under local or national labor law.

Collective Agreement

A written contract negotiated between an employer and a union representing the employees, outlining terms and conditions of employment.

Picket Lines

A form of protest or demonstration by workers, often during a strike, where they line up outside their place of employment to dissuade others from entering.

Duty of Fair Representation

The legal obligation of a union to represent all members fairly, without bias or discrimination.

Q3: Separate company and consolidated income statements for

Q8: On December 5, 2010, Unca Corporation, a

Q22: From the standpoint of accounting theory, which

Q27: Eve, Fig, Gus, and Hal are partners

Q33: A foreign subsidiary's accounts receivable balance should

Q34: The noncontrolling interest share for 2012 was<br>A)

Q44: Refer to Table 9-17.Looking at the table

Q69: The base period for CPI calculations is

Q131: The Bureau of Labor Statistics counts as

Q139: Refer to Table 9-17.Looking at the table