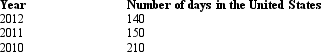

Given the following information,determine whether Greta,an alien,is a U.S.resident for 2012.Assume that Greta cannot establish a tax home in or a closer connection to a foreign country.

Definitions:

Labor Force

The total number of people, including both the employed and unemployed, who are actively seeking and available to work.

Women

Female human beings, distinguished biologically by reproductive functions that can include giving birth.

1960s

A decade marked by significant social, political, and cultural change worldwide, including movements for civil rights and against the Vietnam War in the United States.

Technological Progress

Innovations and improvements in technology that can lead to more efficient production methods and economic growth.

Q16: What are the characteristics of an S

Q41: A _ tier distribution is one that

Q53: Maureen,a calendar year taxpayer subject to a

Q54: Leroy,who is subject to a 45% marginal

Q77: A distribution cannot be "proportionate" if only

Q89: Debt of a limited liability company is

Q113: You are a 60% owner of an

Q125: A partnership must provide any information to

Q125: Lang,an NRA who was not a resident

Q154: Some of the charitable organizations that qualify