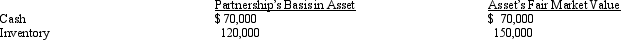

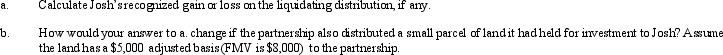

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $300,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Definitions:

Frames of Reference

The experiences, ideas, values, and information that an individual uses to interpret and understand messages.

Miscommunication

A failure to communicate effectively, leading to misunderstandings or confusion.

Organizational Culture

The values, behaviors, and beliefs that contribute to the unique social and psychological environment of a business or organization.

Oral Communication

The exchange of information or ideas through spoken words.

Q25: Milt Corporation owns and operates two facilities

Q25: Which of the following statements regarding constructive

Q53: Stock basis first is increased by income

Q53: When computing E & P,taxable income is

Q65: During the current year,Waterthrush Company had operating

Q74: The granting of a Writ of Certiorari

Q77: Which one of the following statements is

Q103: In 2011,Bluebird Corporation had net income from

Q110: Which of the following statements is true

Q133: A distribution in excess of E &