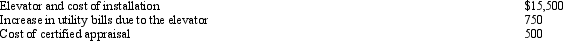

Timothy suffers from heart problems and,upon the recommendation of a physician,has an elevator installed in his personal residence.In connection with the elevator,Timothy incurs and pays the following amounts during the current year:

The system has an estimated useful life of 20 years.The appraisal was to determine the value of Timothy's residence with and without the system.The appraisal states that the system increased the value of Timothy's residence by $2,000.How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation)in the current year?

The system has an estimated useful life of 20 years.The appraisal was to determine the value of Timothy's residence with and without the system.The appraisal states that the system increased the value of Timothy's residence by $2,000.How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation)in the current year?

Definitions:

Joint Custody

A legal arrangement where both parents share decision-making responsibilities and physical care of a child.

Persistent Poverty

A long-term state where an individual or group lives below the minimum level of income deemed necessary to achieve an adequate standard of living.

Common Arrangement

A typical or widely accepted way of organizing or structuring something.

Following Divorce

pertains to the period and adaptations individuals and families undergo after the legal dissolution of a marriage.

Q25: Under the MACRS straight-line election for personalty,the

Q36: A moving expense deduction is allowed even

Q47: Carl,a physician,earns $200,000 from his medical practice

Q48: Brian makes gifts as follows:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4129/.jpg"

Q60: The tax law allows an income tax

Q69: Sean purchased vacant land in 2005 that

Q73: For a corporate distribution of cash or

Q84: Which,if any,of the following factors is not

Q88: Felicia,a recent college graduate,is employed as an

Q100: Steven is single and has AGI of