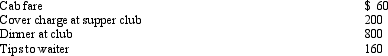

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation,Henry's deduction is:

Presuming proper substantiation,Henry's deduction is:

Definitions:

Limited Liability Partnership

A business structure that offers its owners limited personal liability for the debts and actions of the partnership, while operating with a flexible management structure.

Statutorily Required Filing

Refers to documents or submissions that must be filed according to law or statute.

Obligations

Duties or responsibilities imposed by law, contract, or conscience that one party owes to another.

Assign Partnership Interest

The transfer of a partner's ownership interest in a partnership to another party, subject to the terms of the partnership agreement.

Q11: Henry entertains several of his key clients

Q43: During 2011,Ralph made the following contributions to

Q43: A statutory employee is not a common

Q44: Ed died while employed by Violet Company.His

Q46: Cora purchased a hotel building on May

Q49: In 2012,Grant's personal residence was damaged by

Q76: Rachel participates 150 hours in Activity A

Q111: Scott files his tax return 65 days

Q115: For the year 2012,Amber Corporation has taxable

Q116: A taxpayer who maintains an office in