Multiple Choice

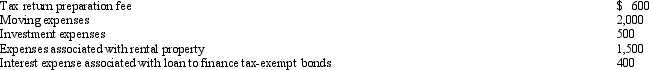

Cory incurred and paid the following expenses:  Calculate the amount that Cory can deduct (before any percentage limitations) .

Calculate the amount that Cory can deduct (before any percentage limitations) .

Definitions:

Related Questions

Q5: On July 10,2012,Ariff places in service a

Q49: Both traditional and Roth IRAs possess the

Q49: On January 5,2012,Tim purchased a bond paying

Q68: Roger is in the 35% marginal tax

Q80: Tara purchased a machine for $40,000 to

Q86: Jack,age 30 and married with no dependents,is

Q87: How do the net operating loss provisions

Q117: Marvin lives with his family in Alabama.He

Q120: Arnold is employed as an assistant manager

Q142: For 2012,Jackson has taxable income of $30,005.When