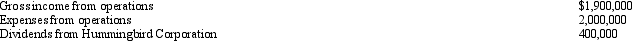

In the current year,Mockingbird Corporation (a calendar year taxpayer) has the following income and expenses:  Mockingbird Corporation owns 10% of the stock of Hummingbird Corporation.The dividends received deduction for the current year is:

Mockingbird Corporation owns 10% of the stock of Hummingbird Corporation.The dividends received deduction for the current year is:

Definitions:

Urinary Tract Infection

A bacterial infection affecting parts of the urinary system, including the bladder, kidneys, ureters, or urethra.

Deep Breathing

A relaxation technique involving intentional deep breaths to reduce stress or anxiety.

Visualization

The technique of creating images, diagrams, or animations to communicate a message or understand a concept visually.

Purulent Yellow Drainage

A sign of infection, characterized by a thick yellowish discharge from a wound or affected area.

Q1: The following assets in Jack's business were

Q13: In § 212(1),the number (1)stands for the:<br>A)

Q23: The term "petitioner" is a synonym for

Q25: Which Regulations have the force and effect

Q30: The Golsen rule has been overturned by

Q36: A participant who is at least age

Q38: The accrual basis taxpayer sold land for

Q75: The annual increase in the cash surrender

Q78: A letter ruling applies only to the

Q136: During the current year,Doris received a large