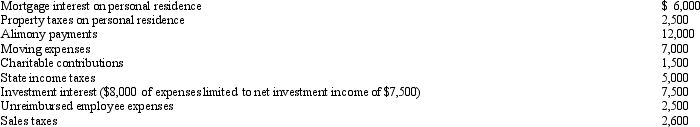

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Definitions:

Opportunity Cost

The value of the next highest valued alternative that is given up when making a decision.

Alternatives Not Chosen

Options that are forsaken when a decision is made in favor of another option.

Q1: A taxpayer who lives and works in

Q31: Which of the following must be capitalized

Q34: Bob lives and works in Newark,NJ.He travels

Q49: Barry purchased a used business asset (seven-year

Q65: None of the prepaid rent paid on

Q75: For personal property placed in service in

Q91: Terry and Jim are both involved in

Q93: Melba incurred the following expenses for her

Q97: As opposed to itemizing deductions from AGI,the

Q118: The stock of Eagle,Inc.is owned as follows:<br>