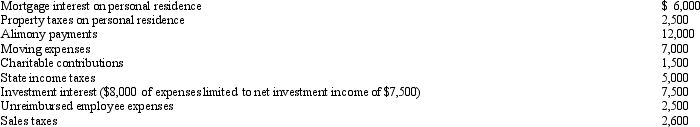

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Definitions:

Corporate Culture

The shared values, beliefs, attitudes, and standards that characterize members of an organization and define its nature.

Business Clothes

Clothing that is appropriate for a professional workplace environment, often including suits, dress shirts, blazers, and formal shoes.

Product Approach

An approach in which the salesperson places the product on the counter or hands it to the customer, saying nothing.

Demonstrations

Live or virtual showcases of a product's features and benefits, designed to educate potential customers and encourage them to make a purchase.

Q8: After graduating from college,Clint obtained employment in

Q12: Qualified moving expenses include the cost of

Q25: A purchased trademark is a § 197

Q33: In 2012,Mary had the following items: <img

Q44: Office Palace,Inc.,leased an all-in-one printer to a

Q52: Marcie moved from Oregon to West Virginia

Q83: Match the statements that relate to each

Q99: Under the right circumstances,a taxpayer's meals and

Q114: Ed died while employed by Violet Company.His

Q133: Which of the following is not deductible?<br>A)