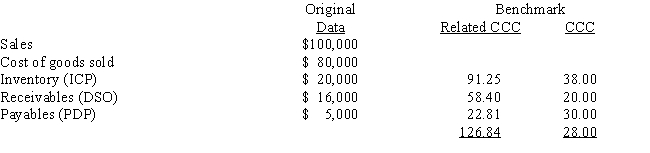

Fontana Painting had the following data for the most recent year (in millions) . The new CFO believes that the company could improve its working capital management sufficiently to bring its NWC and CCC up to the benchmark companies' level without affecting either sales or the costs of goods sold. Fontana finances its net working capital with a bank loan at an 8% annual interest rate, and it uses a 365-day year. If these changes had been made, by how much would the firm's pre-tax income have increased?

Definitions:

Geological Theory

A foundational principle in geology that explains the structure of the Earth’s crust and the processes that shape it over time, including plate tectonics and erosion.

Deposits

Materials laid down or settled from a state of suspension or solution in a fluid, often referring to geological or financial contexts.

Canadian Shield

A large geological shield covered by a thin layer of soil that spans across eastern and central Canada, known for its rich mineral deposits.

Q17: Other things held constant, if a firm

Q18: The market value of any real or

Q32: One of the necessary steps in the

Q43: Suppose a foreign investor who holds tax-exempt

Q45: The trade-off theory states that the capital

Q54: McPherson Company must purchase a new milling

Q67: Spot-Free Car Wash is considering a new

Q68: Your new employer, Freeman Software, is considering

Q79: Different borrowers have different risks of bankruptcy,

Q89: Which of the following statements is CORRECT?<br>A)