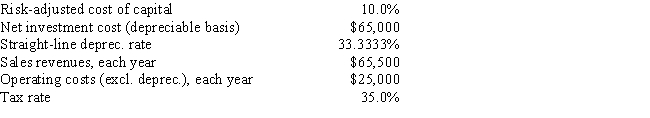

DeVault Services recently hired you as a consultant to help with its capital budgeting process. The company is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

Definitions:

Customer Relationships

The interactions and engagement between a business and its customers, focusing on long-term retention and satisfaction.

CRM Technologies

Tools and software used by businesses to manage customer data and interactions, streamline operations, and improve customer relationships.

Safeguards

Measures or mechanisms put in place to protect against potential harm or ensure security.

Lucrative

Generating a significant profit or financial gain, often used to describe business ventures or investments.

Q5: Suppose firms follow similar financing policies, face

Q8: The primary advantage to using accelerated rather

Q44: Based on the projections, Decker will have<br>A)

Q61: Since receivables and payables both result from

Q66: The level of effort is the same

Q93: It is advisable to build relationship with

Q95: Cost-reimbursement contracts are most appropriate for projects

Q122: The WBS is of deliverables or end

Q123: Accruals are "spontaneous," but unfortunately, due to

Q126: The section of the project scope document