REFERENCE: Ref.09_10 on October 1,2007,Eagle Company Forecasts the Purchase of Inventory from Inventory

REFERENCE: Ref.09_10

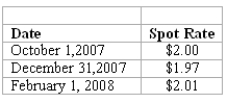

On October 1,2007,Eagle Company forecasts the purchase of inventory from a British supplier on February 1,2008,at a price of 100,000 British pounds.On October 1,2007,Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound.The option is considered to be a cash flow hedge of a forecasted foreign currency transaction.On December 31,2007,the option has a fair value of $1,600.The following spot exchange rates apply:

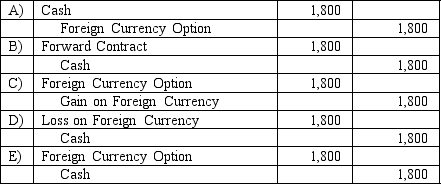

-What journal entry should Eagle prepare on October 1,2007?

Definitions:

Risk-Free Rate

The return on an investment with no risk of financial loss, typically represented by the yield on government securities like U.S. Treasury bonds.

Inflation Rate

The rate at which the general level of prices for goods and services is rising, eroding purchasing power.

Convertible Bond

A type of bond that can be converted into a predetermined amount of the issuer's equity at certain times during its life, usually at the discretion of the bondholder.

Put Option

A financial contract giving the holder the right, but not the obligation, to sell a specified amount of an asset at a set price within a specified time.

Q18: The accrual-based income of Eckston Inc.is calculated

Q26: What is the total noncontrolling interest in

Q28: How much US $ will it cost

Q34: Justings Co.owned 80% of Evana Corp.During 2009,Justings

Q36: What revenues and expenses included in segment

Q38: Which operating segments are reportable under the

Q41: What was the net impact on Mattie's

Q56: What is meant by the spot rate?

Q65: Net cash flow from operating activities was:<br>A)$44,000.<br>B)$44,800.<br>C)$46,200.<br>D)$50,000.<br>E)$52,200.

Q134: A decrease in demand,with supply constant,results in