REFERENCE: Ref.09_10 on October 1,2007,Eagle Company Forecasts the Purchase of Inventory from Inventory

REFERENCE: Ref.09_10

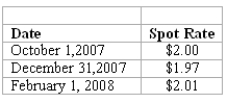

On October 1,2007,Eagle Company forecasts the purchase of inventory from a British supplier on February 1,2008,at a price of 100,000 British pounds.On October 1,2007,Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound.The option is considered to be a cash flow hedge of a forecasted foreign currency transaction.On December 31,2007,the option has a fair value of $1,600.The following spot exchange rates apply:

-What is the amount of Cost of Goods Sold for 2008 as a result of these transactions?

Definitions:

Groundwater

The subsurface water that occupies the pore spaces in soils and rocks, serving as a major source of fresh water for many areas.

Seas Saltier

A condition resulting from the evaporation of ocean water, which increases the concentration of salts, making the seas saltier.

Quartzite

A hard, metamorphic rock formed from quartz-rich sandstone that has undergone heat and pressure transformations.

Weather

The state of the atmosphere at a place and time as regards heat, dryness, sunshine, wind, rain, etc.

Q6: Which of the following conditions will allow

Q34: Assume that society is operating on its

Q41: What was the net impact on Mattie's

Q53: Compute the income from Gargiulo reported on

Q69: Alpha,Inc. ,a U.S.company,had a receivable from a

Q95: Using percentage allocation method,how much income tax

Q103: With regard to the intercompany sale,which of

Q103: Assume the most typical shapes for the

Q115: A professional basketball players' union negotiates a

Q116: Even if economic theory is based on