REFERENCE: Ref.07_18  Patton's operating income excludes income from the investment in Stevens,but includes $150,000 of unrealized gains on intercompany transfers of inventory.Patton uses the initial value method to account for the investment in Stevens.

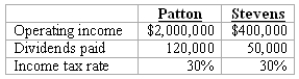

Patton's operating income excludes income from the investment in Stevens,but includes $150,000 of unrealized gains on intercompany transfers of inventory.Patton uses the initial value method to account for the investment in Stevens.

-Assume Patton owns 90 percent of the voting stock of Stevens and files a consolidated income tax return.What amount of income taxes would be paid?

Definitions:

Debt Ratio

A financial metric that measures the proportion of a company's total debt to its total assets, indicating the degree of leverage and financial risk.

Total Debts

The cumulative amount of all debts and liabilities a company or individual owes.

Total Assets

The sum of all owned resources (current and non-current assets) that a company possesses, which can be found on its balance sheet.

Assets Turnover

A financial ratio that measures the efficiency with which a company uses its assets to generate sales.

Q29: Which of the following would be a

Q30: What is the net effect of the

Q35: In consolidation at December 31,2009,what net adjustment

Q49: Lisa Co.paid cash for all of the

Q49: Compute the December 31,2010,consolidated common stock.<br>A)$450,000.<br>B)$530,000.<br>C)$555,000.<br>D)$635,000.<br>E)$525,000.

Q51: Assume that Bullen paid a total of

Q64: Assume the partial equity method is used.In

Q79: Assuming the combination is accounted for as

Q88: Which of the following statements is true

Q112: In one hour,George can fix 4 flat