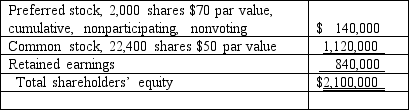

On January 1,2009,Bast Co.had a net book value of $2,100,000 as follows:

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings,with a twelve-year life,was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Definitions:

Canaliculi

Small, channel-like structures in bone tissue that allow for communication and nutrient/waste exchange between osteocytes.

Osteons

The fundamental unit of compact bone, consisting of a central canal surrounded by concentric lamellae of mineralized matrix.

Lacunae

Small spaces, cavities, or gaps found in various tissues, often referring to the spaces in bone or cartilage that contain cells.

Skeletal System

The framework of bones and other connective tissues that support the body and facilitate movement.

Q12: How are bargain purchases different between SFAS

Q15: A statutory merger is a(n)<br>A)business combination in

Q24: Compute the amount of consolidated land at

Q26: Assuming Baker makes the change in the

Q35: Why is push-down accounting a popular internal

Q48: Atherton,Inc. ,a U.S.company,expects to order goods from

Q67: Carl is considering attending a concert with

Q80: Gamma Co.owns 80% of Delta Corp. ,and

Q110: How is the loss on sale of

Q122: Compute consolidated revenues at the date of