REFERENCE: Ref.06_14

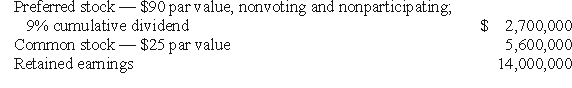

Thomas Inc.had the following stockholders' equity accounts as of January 1,2009:  Kuried Co.acquired all of the voting common stock of Thomas on January 1,2009,for $20,656,000.The preferred stock remained in the hands of outside parties and had a fair value of $3,060,000.A database valued at $656,000 was recognized and amortized over five years.

Kuried Co.acquired all of the voting common stock of Thomas on January 1,2009,for $20,656,000.The preferred stock remained in the hands of outside parties and had a fair value of $3,060,000.A database valued at $656,000 was recognized and amortized over five years.

During 2009,Thomas reported earning $630,000 in net income and paid $504,000 in total cash dividends.Kuried decided used the equity method to account for this investment.

-What was the noncontrolling interest's share of consolidated net income for this period?

Definitions:

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity.

Year 2

A term that could refer to the second year of a specific time period, project, or study.

Equity Multiplier

A financial ratio that measures the amount of a company's assets that are financed by its shareholders' equity.

Common Stock

A type of equity security that represents ownership in a corporation, entitling holders to a share of the corporation's profits and assets.

Q22: Which one of the following is a

Q37: What is the dollar amount of Float

Q43: Compute the amount of consolidated buildings (net)at

Q50: MacHeath Inc.bought 60% of the outstanding common

Q57: With regard to the intercompany sale,which of

Q61: Determine the amortization expense related to the

Q71: What is the balance in Investment in

Q76: Assume that Botkins acquired Volkerson as a

Q83: Assuming Baker makes the change in the

Q109: For each of the following situations,select the