REFERENCE: Ref.03_07

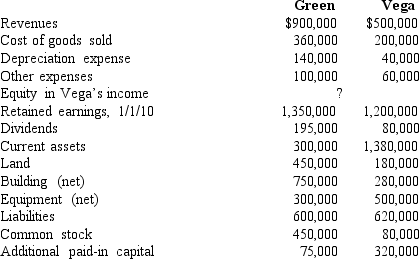

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated land.

Definitions:

Utility Function

An economic depiction of the way a consumer prioritizes various goods or combinations of goods.

Revenue Maximizing Price

The price point at which a company can generate the maximum amount of revenue from selling its product or service, considering the demand and cost factors.

Football Tickets

Football tickets are passes that allow entry to watch a football game, often sold by teams or authorized vendors.

Demand

The amount of a product or service that buyers are prepared and capable of buying at different price levels.

Q22: What is meant by the term fiscally

Q27: Gonda,Herron,and Morse is considering possible liquidation because

Q30: All of the following are examples of

Q37: What term is used by voluntary health

Q49: Lisa Co.paid cash for all of the

Q56: Assuming Atwood accounts for the combination as

Q80: On January 1,2009,Rand Corp.issued shares of its

Q87: Required:<br>Under the treasury stock approach,what is Jull's

Q103: With regard to the intercompany sale,which of

Q107: Compute the noncontrolling interest in Ross' net