REFERENCE: Ref.03_12 Watkins,Inc.acquires All of the Outstanding Stock of Glen Corporation on Corporation

REFERENCE: Ref.03_12

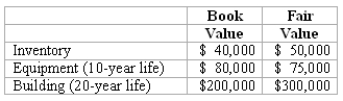

Watkins,Inc.acquires all of the outstanding stock of Glen Corporation on January 1,2009.At that date,Glen owns only three assets and has no liabilities:

-If Watkins pays $450,000 in cash for Glen,what allocation should be assigned to the subsidiary's Equipment in preparing for consolidation at December 31,2011,assuming the book value at that date is still $80,000?

Definitions:

Variable Costing Income (VCI)

An accounting method that includes only variable costs—costs that change with production level—in calculating net income.

Full Costing Income (FCI)

A method of accounting that allocates all fixed and variable costs to products, operations or projects to determine profitability.

Consolidated Accounts

Financial statements that represent the combined financial activities of a parent company and its subsidiaries.

Absorption Costing

A costing approach that encompasses all costs associated with production, namely direct materials, direct labor, and both variable and fixed overheads, in the product's final cost.

Q22: Prepare the journal entry to record the

Q32: If the equity method had been applied,what

Q51: What are the three broad sections of

Q65: The Arnold,Bates,Carlton,and Delbert partnership was liquidating.It had

Q66: Woods Company has a building worth $800,000.Because

Q73: A local partnership was considering the possibility

Q86: The accrual-based income of Maroon Corp.is calculated

Q89: Assume that Bullen paid a total of

Q101: What is this pattern of ownership called?<br>A)pyramid

Q120: Assume the initial value method is used.In