REFERENCE: Ref.03_12 Watkins,Inc.acquires All of the Outstanding Stock of Glen Corporation on Corporation

REFERENCE: Ref.03_12

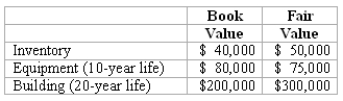

Watkins,Inc.acquires all of the outstanding stock of Glen Corporation on January 1,2009.At that date,Glen owns only three assets and has no liabilities:

-If the transaction instead occurred on January 1,2008 under a SFAS 141 purchase combination,and Watkins pays $300,000 in cash for Glen,at what amount would the subsidiary's Equipment be represented in a December 31,2011 consolidation?

Definitions:

Fundamentalist Christianity

A conservative movement within Christianity that emphasizes literal interpretations of sacred texts and adherence to traditional Christian doctrines.

Sociological Perspective

A viewpoint that involves looking at social life in a scientific, systematic way to understand the patterns and structures that shape society.

Human Life

The existence of an individual human being from birth to death, including physical, social, and cultural experiences that define each person's unique identity.

Society

A community of people living in a particular country or region and having shared customs, laws, and organizations.

Q18: Edgar Co.acquired 60% of Kindall Co.on January

Q24: Blanton Corporation is comprised of five operating

Q26: Keefe,Inc. ,a calendar-year corporation,acquires 70% of George

Q28: What is the non-controlling interest's share of

Q42: With regard to the intercompany sale,which of

Q45: Historically,what was the pattern of reporting of

Q69: Strayten Corp.is a wholly owned subsidiary of

Q91: Assuming the combination is accounted for as

Q109: For each of the following situations,select the

Q115: Assuming Atwood accounts for the combination as