REFERENCE: Ref.03_07

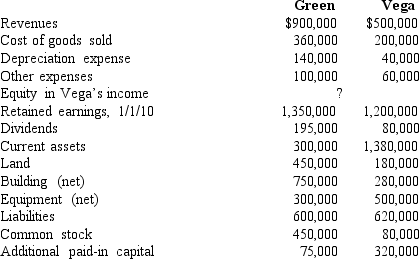

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated total expenses.

Definitions:

Euchromatin

A lightly packed form of chromatin (DNA, RNA, and protein complex) that is enriched in gene concentration and is active in transcription.

Barr Bodies

Inactivated X chromosomes found in the nuclei of cells in female organisms, visible as a dense mass, and a key component in dosage compensation.

Promoters

DNA sequences located near the beginning of a gene that signal RNA polymerase where to start transcription.

Frameshift Mutation

A genetic mutation caused by insertions or deletions of a number of nucleotides in a DNA sequence that is not divisible by three, altering the reading frame.

Q18: The Yelton Center is a voluntary health

Q28: During 2008,the Garfield Humane Society,a voluntary health

Q32: If the equity method had been applied,what

Q40: What is Ryan's percent ownership in Chase

Q51: If this combination is viewed as an

Q52: .The City of Wetteville has a fiscal

Q55: Velway Corp.acquired Joker Inc.on January 1,2009.The parent

Q58: Consolidated net income using the equity method

Q101: Prepare the journal entries to reflect the

Q107: Hoyt Corporation agreed to the following terms