REFERENCE: Ref.03_14

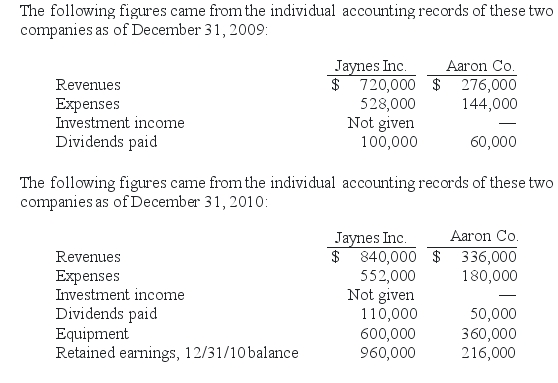

Jaynes Inc.obtained all of Aaron Co.'s common stock on January 1,2009,by issuing 11,000 shares of $1 par value common stock.Jaynes' shares had a $17 per share fair value.On that date,Aaron reported a net book value of $120,000.However,its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records.Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

SHAPE \* MERGEFORMAT

-If this combination is viewed as an acquisition,what was consolidated equipment as of December 31,2010?

Definitions:

Consumer-oriented

An approach focusing on meeting the needs and expectations of consumers, prioritizing their satisfaction and engagement.

Holistic Health

An approach to well-being that considers the whole person—body, mind, spirit, and emotions—in the pursuit of optimal health and wellness.

Motivational Interviewing

A counseling approach that helps people resolve ambivalent feelings and insecurities to find the internal motivation they need to change their behavior.

Person-centered Therapy

A non-directive psychotherapy approach that emphasizes the client's self-discovery and self-acceptance through a supportive therapeutic environment.

Q16: What consolidation entry would have been recorded

Q16: Kordel Inc.holds 75% of the outstanding common

Q21: Compute consolidated inventory at date of acquisition.<br>A)$1,650.<br>B)$1,810.<br>C)$1,230.<br>D)$580.<br>E)$1,830.

Q24: For consolidation purposes,what net debit or credit

Q25: Which of the following statements is false

Q47: Chapel Hill Company had common stock of

Q67: Fiduciary funds are<br>A)Funds used to account for

Q70: What is the controlling interest share of

Q72: Compute consolidated cost of goods sold.<br>A)$7,500,000.<br>B)$7,600,000.<br>C)$7,615,000.<br>D)$7,604,500.<br>E)$7,660,000.

Q80: On January 1,2009,Rand Corp.issued shares of its