REFERENCE: Ref.03_07

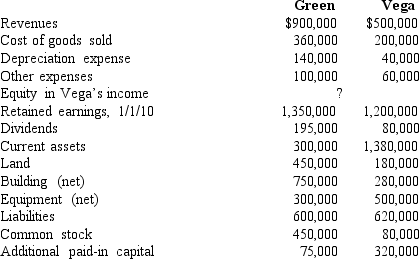

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated total expenses.

Definitions:

Intellectual Ability

involves the capacity to perform mental activities such as reasoning, problem-solving, and abstract thinking.

Intelligence Quotient

A measure of a person's intellectual abilities compared to the average population, typically computed from the results of standardized tests.

Katz's Skills Model

A leadership model proposed by Robert Katz that suggests three core leadership skills: technical, human, and conceptual.

Tax Law

The legal domain encompassing rules, policies, and procedures that oversee the legal process regarding taxation.

Q4: The impact of the consolidation on consolidated

Q12: Prepare the journal entry to record the

Q13: Under the purchase method of accounting for

Q15: A demonstrative legacy is a<br>A)gift of personal

Q35: Which statement is false regarding the Balance

Q36: The Abrams,Bartle,and Creighton partnership began the process

Q44: Flintstone Inc.acquired all of Rubble Co.on January

Q82: For an acquisition when the subsidiary maintains

Q84: How much income tax expense is recognized

Q92: Compute the December 31,2010,consolidated total expenses.<br>A)$620,000.<br>B)$280,000.<br>C)$900,000.<br>D)$909,625.<br>E)$299,625.