REFERENCE: Ref.03_07

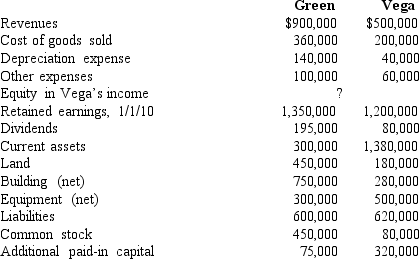

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated trademark.

Definitions:

Writing Skills

The ability to express ideas and communicate information effectively through written text.

Paragraph Length

The measure of a paragraph's length in sentences or words, influencing readability and reader engagement.

Readable

The quality of text being clear and easy to understand or interpret by the reader.

Knowledgeable

Possessing or showing understanding or information about a particular subject or field.

Q1: In a pooling of interests,<br>A)revenues and expenses

Q2: What is consolidated net income?<br>A)$229,500.<br>B)$237,000.<br>C)$245,000.<br>D)$232,500.<br>E)$240,000.

Q3: What related items in regard to total

Q17: A five-year lease is signed by the

Q28: What three criteria must be met to

Q34: Compute the amount of Hurley's equipment that

Q43: What is the balance in Noncontrolling Interest

Q86: The accrual-based income of Maroon Corp.is calculated

Q89: Pursley,Inc.owns 70 percent of Harry,Inc.The consolidated income

Q93: Describe how this transaction would affect Panton's