REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

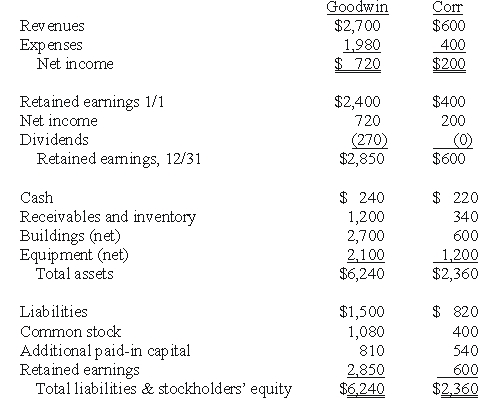

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assumiing the combination is accounted for as a purchase,compute the consolidated retained earnings at December 31,20X1.

Definitions:

Organizational Climate

The general atmosphere, culture, and morale felt by employees and the prevailing attitudes towards work and the company.

Synergistic Effect

The phenomenon where the combined effect of collaborating elements is greater than the sum of their individual effects.

Creativity

The ability to generate innovative ideas and solutions by thinking outside the conventional boundaries.

Innovation

The process of introducing new ideas, devices, or methods to improve goods, services, or processes.

Q6: How much goodwill impairment should Pritchett report

Q17: Prepare the journal entry to record payment

Q18: Which type of fund is not included

Q26: For a voluntary health and welfare organization,what

Q38: What are the benefits or advantages of

Q54: Prepare journal entries to record the actual

Q88: Compute Simon's share of income from Wilson

Q92: After acquiring the additional shares,what adjustment is

Q100: Tara Company holds 80 percent of the

Q112: Hambly Corp.owned 80% of the voting common