REFERENCE: Ref.02_06

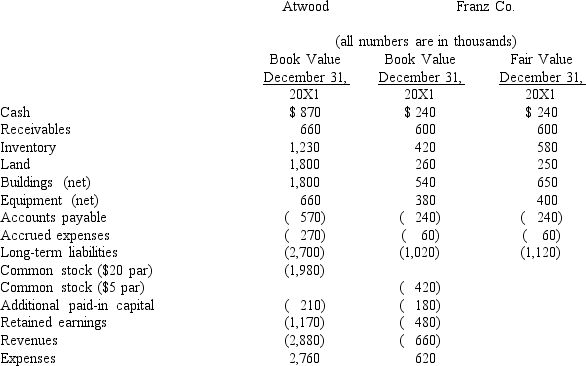

The financial balances for the Atwood Company and the Franz Company as of December 31,20X1,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,20X1.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Assuming the combination is accounted for as a purchase,compute consolidated retained earnings at the date of the combination.

Definitions:

Emotional Intelligence

The ability to understand and manage one's own emotions and the emotions of others, facilitating improved communication, management, problem-solving, and relationships.

Social Skills

The abilities that facilitate interaction and communication with others, including empathy, conflict resolution, and effective listening.

Salesforce Training

Educational programs and initiatives aimed at improving the skills, knowledge, and effectiveness of a company's sales force.

Sales Managers

Individuals responsible for directing and overseeing a sales team to achieve sales targets and goals.

Q2: Prince Corp.owned 80% of Kile Corp.'s common

Q8: Which entry would be the correct entry

Q10: Which of the following will be included

Q23: Which entry would be the correct entry

Q29: On the consolidated financial statements,what amount should

Q39: What is the balance in Cale's investment

Q47: The town of Conway opened a solid

Q51: If this combination is viewed as an

Q70: Which standard issued by the Governmental Accounting

Q110: How is the loss on sale of