REFERENCE: Ref.02_04 on January 1,20X1,the Moody Company Entered into a Transaction for Transaction

REFERENCE: Ref.02_04

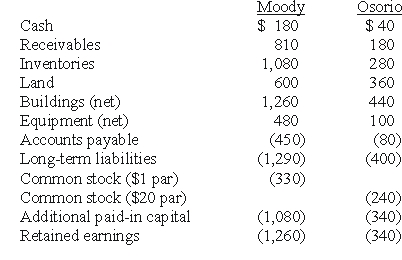

On January 1,20X1,the Moody company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this purchase.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated inventories at date of combination.

Definitions:

Example

A specific instance or illustration used to explain or support a claim or concept.

Model

A representation, either physical, mathematical, or conceptual, used to describe and predict real-world behaviors, systems, or phenomena.

Positive Thinking

A mental attitude focusing on the bright side of life and expecting positive results.

Opportunities

Chances or prospects for advancement, success, or profit in various aspects of life, including career and personal development.

Q9: The hospital estimated that contractual adjustments would

Q23: Which of the following statements is true

Q28: The following are preliminary financial statements for

Q31: Cadion Co.owned control over Knieval Inc.Cadion reported

Q50: What was the balance in Thurman's Capital

Q57: What is the total noncontrolling interest in

Q61: The trustor is the<br>A)income beneficiary of the

Q76: When consolidating a subsidiary under the equity

Q87: How do subsidiary stock warrants outstanding affect

Q115: Knight's diluted earnings per share (rounded)is calculated