REFERENCE: Ref.02_04 on January 1,20X1,the Moody Company Entered into a Transaction for Transaction

REFERENCE: Ref.02_04

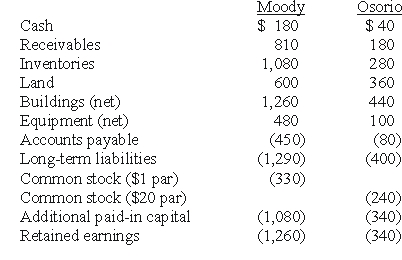

On January 1,20X1,the Moody company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this purchase.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated equipment at date of combination.

Definitions:

Presidential Veto

is the power of the President to reject a bill passed by Congress, preventing it from becoming law unless Congress votes to override the veto.

Presidential Vetoes

The power of the President to reject a bill passed by the Congress, which can be overridden only by a two-thirds majority in both houses.

Congress

The legislative branch of the United States government, divided into the Senate and the House of Representatives.

Federal Troops

Military forces operated and maintained by the federal government of a country.

Q5: On November 8,2009,Power Corp.sold land to Wood

Q10: Which statement below is not correct?<br>A)The accounting

Q14: A city enacted a special tax levy

Q18: Which of the following is a section

Q34: Prepare a Statement of Net Assets

Q54: What are the essential criteria for including

Q55: For May 2008,Carlington Hospital's charges for patient

Q56: What is the partial equity method? How

Q91: Compute income from Stiller on Leo's books

Q104: Which of the following statements is false