REFERENCE: Ref.02_05

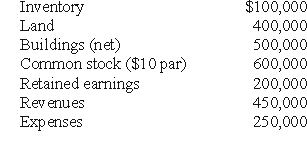

Carnes has the following account balances as of May 1,2000 before a pooling of interests transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On May 1,2000,Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On May 1,2000,Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock.

-Assume Riley issues 70,000 shares instead of 30,000 at date of acquisition.Riley currently has $40,000 of additional paid-in capital on its books.By how much will Riley's retained earnings increase or decrease as a result of the combination?

Definitions:

Inflamed Tissue

Swollen and often reddened body tissue that is reacting to injury or infection.

Antibiotic

Medicinal substances used to kill or inhibit the growth of bacteria, treating and preventing bacterial infections.

Infected Orthopedic Injury

A condition where an injury related to bones, joints, or muscles becomes contaminated with harmful microorganisms, causing inflammation and infection.

Q15: Under SFAS 141 for purchase Business Combinations,what

Q21: Compute consolidated inventory at date of acquisition.<br>A)$1,650.<br>B)$1,810.<br>C)$1,230.<br>D)$580.<br>E)$1,830.

Q40: How much should be reclassified on the

Q41: Which of the following is not subtracted

Q50: Required:<br>Determine consolidated Net Income for at December

Q55: For May 2008,Carlington Hospital's charges for patient

Q71: A local partnership was considering the possibility

Q73: What was the balance in Eaton's Capital

Q91: When a company applies the initial value

Q112: If this combination is viewed as an