Figure:

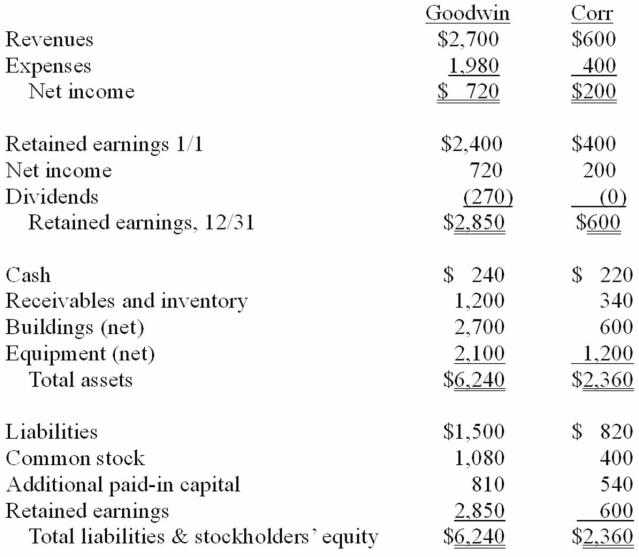

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated additional paid-in capital at December 31, 20X1.

Definitions:

Traditional Quality Assurance

Conventional methods and procedures designed to ensure that products or services meet specific quality standards prior to their delivery.

Culture of Safety

An organizational work environment where safety concerns can be raised openly, and mistakes lead to learning rather than punishment.

Process Teams

Process teams are groups of individuals who work together specifically to analyze, manage, and improve business processes and workflows within an organization.

Day-To-Day Operations

The regular activities and routines that a business or organization conducts on a daily basis to maintain its function.

Q11: Which of the following statements is true

Q11: What is the appropriate account to debit

Q13: Harding,Jones,and Sandy is in the process of

Q25: The city of Nextville operates a motor

Q26: What assets would be included in the

Q31: With regard to the intercompany sale,which of

Q33: Assume the equity method is applied.How much

Q40: Assuming the combination is accounted for as

Q42: With regard to the intercompany sale,which of

Q47: Compute the gain or loss on the